SmallCap Dividend Fund (DES)Ī dividend screen can seem like an ill-advised strategy for small-caps, says David Kletz, a portfolio manager with Forstrong Global Asset Management Inc. The SLY has returned about 15 per cent over the past year and about 10 per cent and 13 per cent annualized over the past five and 10 years, respectively. Small-cap Index ETF (CAD-Hedged) (XSU) with a 0.36 MER. Investors who still prefer the broader diversification of the Russell 2000 can find plenty of low-cost ETF options, including the iShares U.S. Over the last five years, for example, the S&P 600 has increased by more than 47 per cent while the Russell 2000 is up about 40 per cent (all performance data as of Jan. Since reconstitution occurs at the same time annually, many holdings experience downward price pressure as “fund managers are forced to sell winners and buy losers, thereby creating a negative momentum portfolio,” according to a 2015 study by S&P Dow Jones Indices Research.

according to the market-cap weighting each June. The SLY also adds and subtracts companies on an as-needed basis, while the Russell 2000 ranks the top 2,000 small-caps in the U.S. Gordon Ross, a portfolio manager with Vancouver-based Modernadvisor.ca, believes ETFs tracking the S&P SmallCap 600 Index are likely to outperform those mirroring the Russell 2000 because the S&P 600 employs a handful of criteria to determine constituents besides just market-cap weighting.

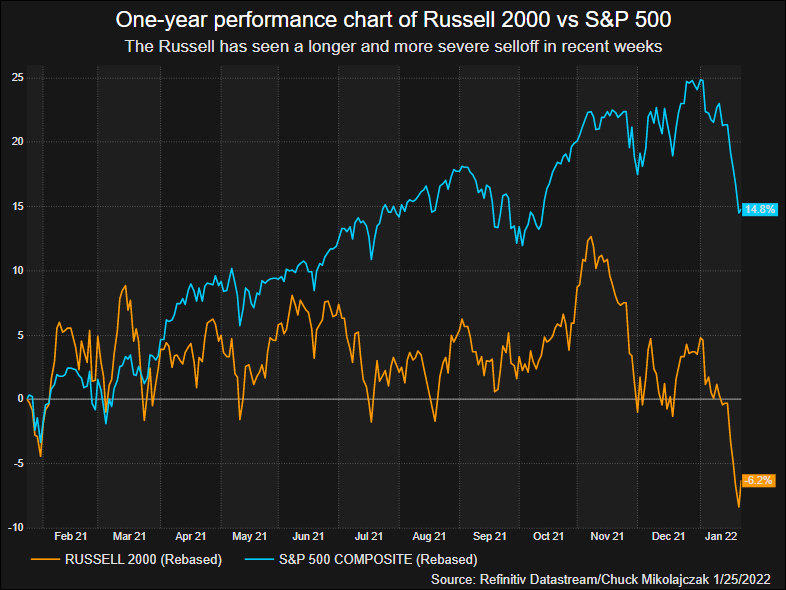

Here are five funds to consider, based on interviews with three market experts: SPDR S&P 600 Small-cap ETF (SLY)Ī market-cap-weighted ETF with a 0.15 per cent management-expense ratio (MER), SLY follows the S&P SmallCap 600 Index instead of the Russell 2000. Investors seeking small-cap exposure through ETFs have a number of options to choose from. In a recent Bloomberg survey, four of five strategists forecasted the small-cap index to outperform the S&P 500 in 2020. Longer-term, the Russell 2000 has outperformed the S&P 500, growing by more than 326 per cent compared to about 222 per cent for the broader index, as of Jan. 10, 2020, while the small-cap benchmark grew by about 40 per cent.

The S&P 500 grew by almost 60 per cent between Jan. Over the last five years, the Russell 2000 Index – the broadest small-cap index in the U.S – trailed the S&P 500 Index. However, he notes that hasn’t been the case in recent years. Conversely, small-cap firms are generally riskier and more volatile and “financial market theories generally hold that more risk should get long-term better returns,” Mr.

The size effect is based on the notion that smaller firms – if successful – should have more room to grow by market capitalization than large-cap stocks, which are typically slow-growing and involve less risk and volatility. “This theory that small-caps should outperform larger-caps is based on something called the ‘size effect,’” says Alan Fustey, portfolio manager with Adaptive ETF in Winnipeg, a division of Bellwether Investment Management Inc. At least, that’s the general theory behind investing in small-cap stocks, which can range between $100-million and more than $3-billion in market capitalization, depending on the index. If you’re bullish on the global economy, small-cap exchange-traded funds are potentially a low-cost, diversified way to outperform broader equity benchmarks.

0 kommentar(er)

0 kommentar(er)